Income Generation

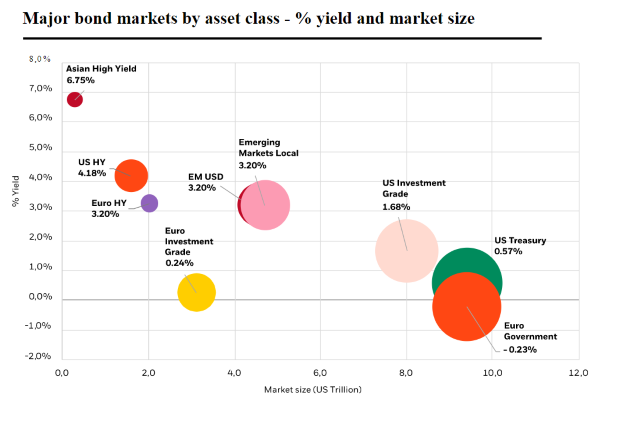

With yields at record lows, investors will soon realize that traditional fixed income portfolios will struggle to generate meaningful income or return. Investors will need to go beyond bonds and rethink their portfolios, to meet their income and return targets in a low-yielding world.

Investment Approach

Seeks to invest in high-quality, dividend-paying companies, primarily domiciled in the U.S. The team pays especially close attention to the potential for dividend growth to drive returns.

VictorWealth’s comprehensive income capabilities can optimize yield for risk, delivering for specific income objectives depending on your portfolio.

Learn how we deliver income through our range of asset classes that cater to different outcomes, whether it be reaching for higher yield, income and growth, or portfolio resilience.

Investment Focus:

1. U.S. large cap value portfolio of high quality companies

2. Invests in companies with a greater potential for dividend growth

3. Seeks lower volatility equity returns

Roll over your old 401k/IRA into a VictorWealth IRA and get up to $2,500 cash

Get up to $2,500 cash when you open a VictorWealth taxable or retirement account by November 24, 2021 and make a qualifying deposit.

Roll over your old 401k/IRA into a VictorWealth IRA

Advantages

- Your investments will remain tax-deferred until you withdraw them

- You will have access to a wide range of investments

- You will have access to a wide range of tools, resources, and services

- You may have the flexibility to convert to a Roth IRA

- You may still have the option to move assets to a future employer’s plan later

- You may be able to take penalty-free withdrawals prior to age 59½ in special circumstances (such as higher education expenses, health insurance premiums or a first-time home purchase)

- Your VictorWealth IRA will not incur an annual account maintenance fee (Management fees apply)

Disadvantages

- You will not be able to take a loan against your account

- Any outstanding plan loan balances would need to be repaid prior to rolling over or you may incur income taxes and potentially a 10% tax penalty

- Your investment activity will incur management fees.

- You may not have access to the exact same investments in an IRA that you had in your plan

- The level of protection from creditors for assets in an IRA is lower than in a plan

- If you hold appreciated employer stock in your former employer’s plan account, there may be tax consequences. You should consult with a tax advisor